It isn’t enough just to simply hold tokens these days in your wallet or exchange account, essentially hoping that you’ve made the right investment. Why leave it up to chance when you can earn passive income on your own digital assets instead of letting them collect proverbial cobwebs. The Compound (COMP) token can help with your passive income goals.

Both trading and investing can be inherently risky, which is why it is essential to do your research when purchasing a new digital asset. On top of that, you owe it to yourself to explore all avenues of possible income, including the world of decentralized finance.

What is Decentralised Finance?

Decentralised finance, or DeFi for short, is an emerging alternative challenging the status quo and centuries of traditional, centralised banking. Instead of relying on intermediaries that are more than happy to take a generous cut of your hard-earned money, DeFi enables and empowers individuals to squeeze more wealth out of their investments. At the same time, users can help provide the system with a means to offer decentralised financial services like lending, liquidity provision, insurance, and more.

By lending digital assets to decentralised finance protocols and platforms, investors are generously rewarded for their help with various types of incentives, which begs the question: why wouldn’t you consider lending your assets to DeFi platforms instead of letting them collect dust in your wallet?

Introducing Compound and the COMP Token

There is no shortage of DeFi platforms in the digital asset space, so choosing one can be pretty overwhelming if you aren’t sure what to look for. Knowing which chain to choose, which tokens to provide liquidity for, how risky a platform is, and how to actually make money on a DeFi platform can also be quite challenging.

Compound is an innovative protocol that hosts a wide variety of pools on the Ethereum network for digital assets like Tether, Wrapped BTC, Ether, DAI, Chainlink, and its own native governance token, COMP.

Users of the Compound platform can either loan their digital assets like Ether or Tether to these decentralised pools or borrow the very same assets. These transactions are run through heavily audited smart contracts, and borrowing/lending rates are calculated according to algorithms encoded into said smart contracts.

Why it Makes Sense to Own the COMP Token

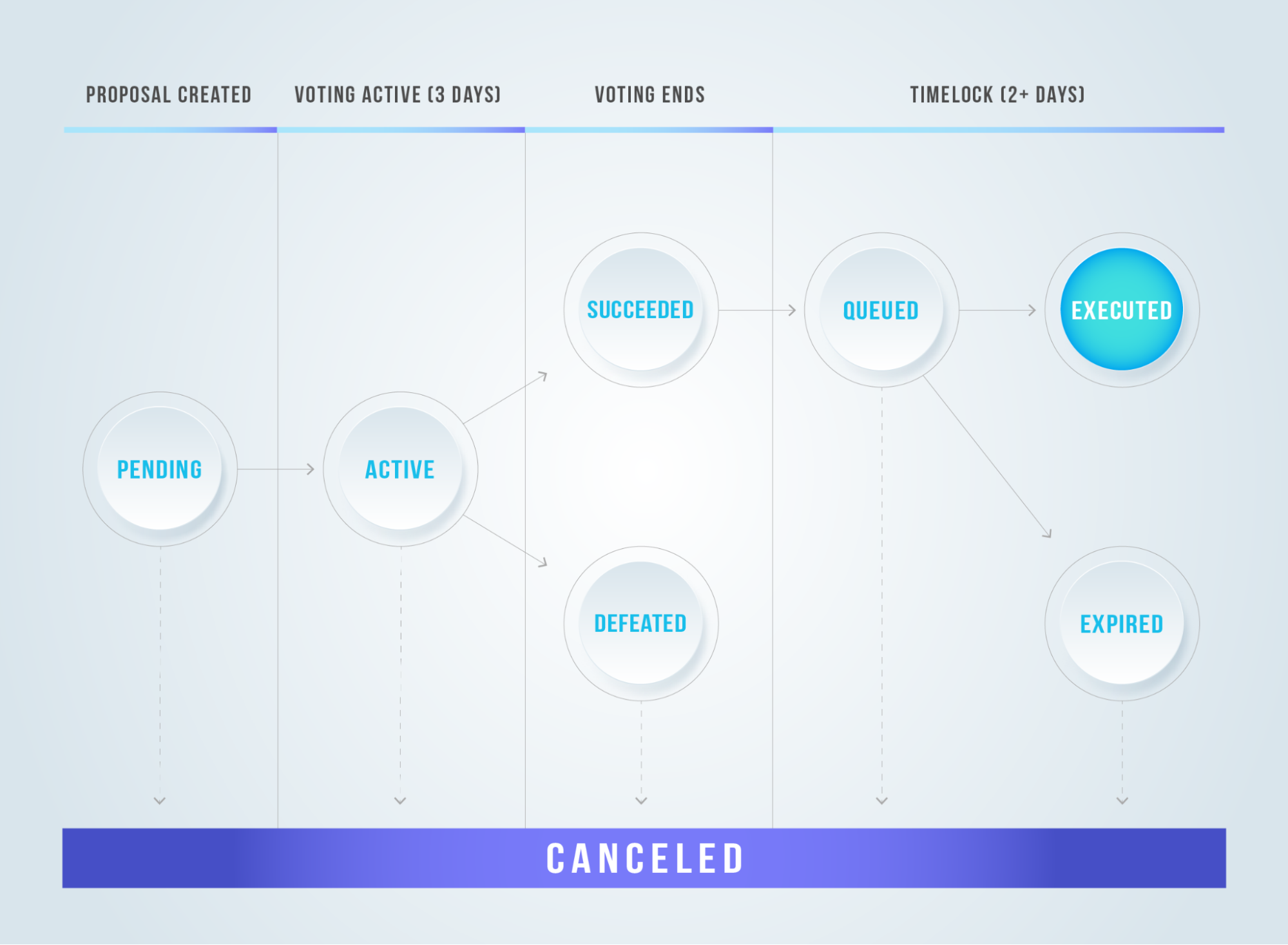

It might seem obvious, but due to the decentralised nature of Compound, governance is one of the main features of the COMP token. This essentially means that those that hold the token play an integral part in moving the protocol in the right direction. It is important to note that those that loan their digital assets to the platform are given interest fees paid by the borrower. These fees are paid out in the COMP token, and the payout rate fluctuates depending on the amount loaned.

Another exciting function users can utilise on Compound’s platform is the right to borrow any digital asset when you are already loaning a different digital asset.

At the end of the day, it makes plenty of sense to put your digital assets to work on DeFi platforms like Compound to help strengthen the blockchain ecosystem while also making healthy returns.

You can find the COMP token on several major centralised exchanges, and we’re proud to list it on the SMART VALOR platform as well. Start your DeFI journey today by signing up for SMART VALOR and start trading or investing in projects like Compound immediately!

Source: blockspaper.com

Chohan, Usman W., Decentralized Finance (DeFi): An Emergent Alternative Financial Architecture (January 26, 2021). Critical Blockchain Research Initiative (CBRI) Working Papers, Available at SSRN: here or here

Harvey, Campbell R. and Ramachandran, Ashwin and Santoro, Joseph, DeFi and the Future of Finance (April 5, 2021). Available at SSRN: here or here