A century ago, the majority of investors picked one of two major investment options – stocks or bonds. Unfortunately, due to a severe lack of diversification, many lost their life savings during the Great Wall Street Crash of 1929.

Market crashes are still a part of the financial landscape. But modern investors have access to many different types of financial securities, belonging to asset classes like equities, cash equivalents, fixed income, real estate, commodities, and other alternative assets.

With the advent of blockchain, a new breed of digital investment options have also entered the fray – cryptocurrencies, non-fungible tokens (NFTs), Decentralized Finance (DeFi), and the proposed Central Bank Digital Currencies (CBDCs) – collectively, they are called digital assets.

Digital Assets – a New Asset Class?

There is considerable debate regarding the position of digital assets in the current classification of asset classes. One school of thought contends that since they all share a decisive common feature – reliance on computers and the internet – they should exist as a separate new asset class.

While there is some merit in that argument, a closer look at the different digital assets shows us something else – they all have vastly different yields, volatility, and risk levels. Here is a quick comparison table matching digital assets to their traditional counterparts:

Asset classes are formed by grouping together securities that share similar characteristics. They also share the same regulations. This is another reason to consider digital assets as new entries into traditional asset classes. For instance, many countries regulate Bitcoin as a commodity, not cash equivalent, despite being a crypto-’currency’.

Lending for Yield with DeFi

In traditional financial networks, there are many intermediaries in place to facilitate transactions. For example, some handle security and validation, while others provide liquidity. However, systems based on blockchain technology do not require many of these intermediaries.

But like any financial system, the digital blockchain also requires liquidity. So, somebody has to step in and take the role of the brokerage house/bank/market maker. Decentralized finance allows anybody to step in and provide liquidity through lending protocols and apps.

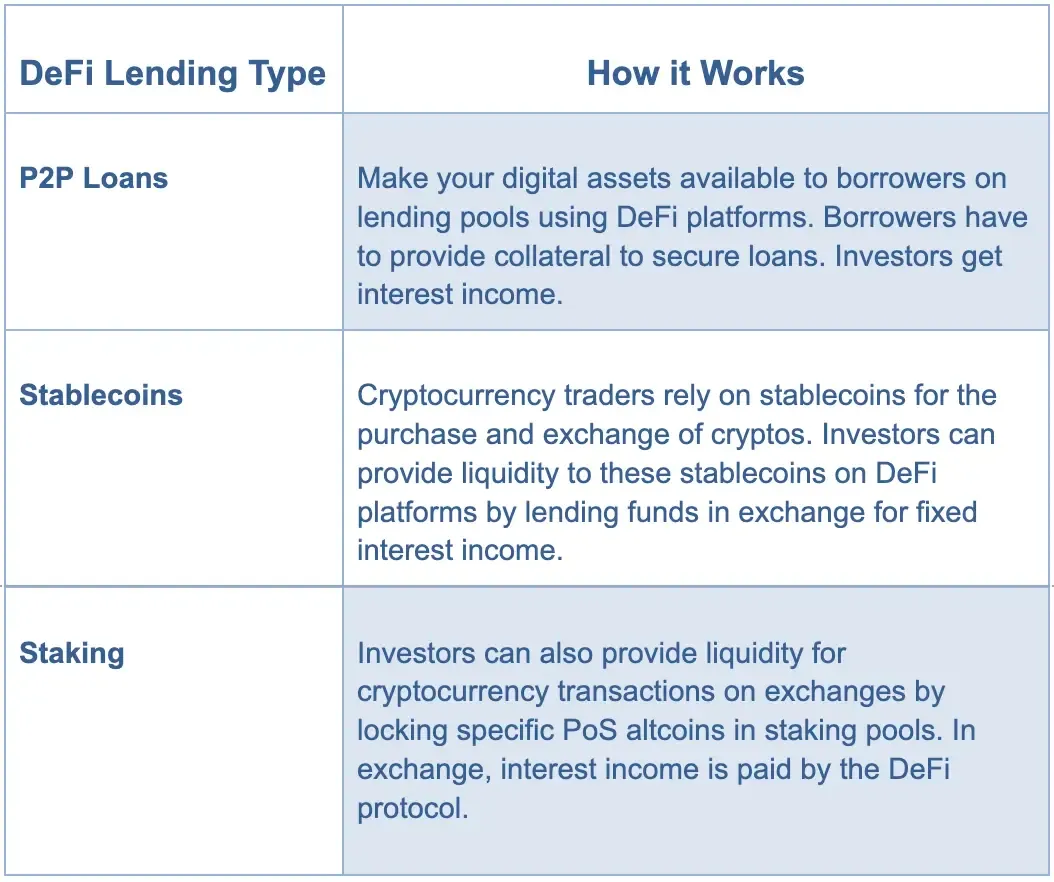

DeFi arose on the highly versatile Ethereum blockchain, where numerous tokens, apps, and use-cases created an urgent need for liquidity and stability. There are several ways in which investors can earn interest income using DeFi lending:

DeFi Lending vs. Traditional Asset Classes

DeFi lending is largely analogous to fixed income asset classes, and one sensible option would be to compare DeFi yields with treasury bond yields and corporate debt securities. But to accurately depict the investment potential of DeFi lending, we will look at other traditional asset classes as well.

Cash: up to 2.5%

Holding unused cash idle is not recommended as you run the risk of losing out on purchasing power due to inflation. Surplus fiat currency reserves will generate interest income when placed in bank accounts, fixed deposits etc. But this is quite low, starting at 0.01% annual interest in basic savings accounts and going up to 2.5% max in high-interest accounts.

Equity: 6% to 10% (minimum)

It is not easy to provide a fixed number as an expected yield while investing in stocks. Given the sheer array of options available in a dynamic market, performances can vary wildly. However, taking a historical approach, the average return from the stock market over the last century is 10%. Take into account inflation, and you can keep 6% as a conservative minimum acceptable return.

Fixed Income: 0.25% to 7.5%

There used to be an era when US treasury bonds yielded annual returns of 15% or more (1981). But over the last few decades, this figure has shrunk dramatically and sits at historic lows of 1.21% on a US Treasury 5 year bond. Corporate debt securities are not faring much better, with even AAA bond ETFs annual yields between 1.10% and 3.50%.

Gold: 5% to 12%

Investors often use precious metals like gold as a hedge against market fluctuations. But gold can generate significant RoI in times of economic crisis as its value increases when the stock market declines. Over the longer term, stocks generally outperform gold investments by a considerable margin. Gold returns since 1990 have averaged around 5% on the lower end, with frequent dips happening at least one-third of the time.

DeFi Assets

In general, the returns on DeFi platforms score favorably when compared to traditional asset classes. This is especially true against fixed income assets like bonds, which rarely generate above 5% annual yields in the current economic climate.

Depending on the platform and crypto/token involved, you can expect interest rates anywhere between 2% to 30% or more with DeFi lending. For comparison’s sake, 8% is a safe number to be considered as an average.

As for crypto staking on digital asset exchanges, returns are slightly lower – a tradeoff for reduced risk. With established altcoins like Ethereum (ETH), Cardano (ADA), Tezos (XTZ), and Polkadot (DOT), expect the annual returns (APY) between 3% and 7%, with a median of 5%.

Stablecoin DeFi protocols can generate around 7% to 8% annual returns on average on over-collateralized loans that deliver maximum security for your investment. Few, if any, traditional fixed interest asset class securities can match these numbers.

Conclusion

With an emphasis on reduced volatility, collateralization, and stability, DeFi protocols have changed the landscape of blockchain investing. Though it lacks the astronomical growth potential of Bitcoin and other altcoins, DeFi more than makes up for that with a promise of fixed returns and yields higher than most traditional asset classes.

For risk-averse investors seeking exposure to the exciting world of blockchain, DeFi lending may be the ideal starting point. It could make a fine addition to a balanced portfolio, focusing heavily on risk management and assured returns. For aspiring DeFi investors, SMART VALOR offers a trusted and reputed exchange platform, with crypto buying, selling and staking opportunities aplenty.

Stats Sources

Stablecoin interest rates

https://www.coininterestrate.com/stablecoin-interest-rates/

Crypto lending interest rates

https://defirate.com/lend/

https://interest.coinmarketcap.com/

Staking APY rates

https://coinmarketcap.com/alexandria/article/crypto-staking-guide-2021

https://coinmarketexpert.com/staking/

Stock market average returns

https://www.nerdwallet.com/article/investing/average-stock-market-return

Treasury bond yields

https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

Corporate bond ETFs

https://etfdb.com/etfdb-category/corporate-bonds/