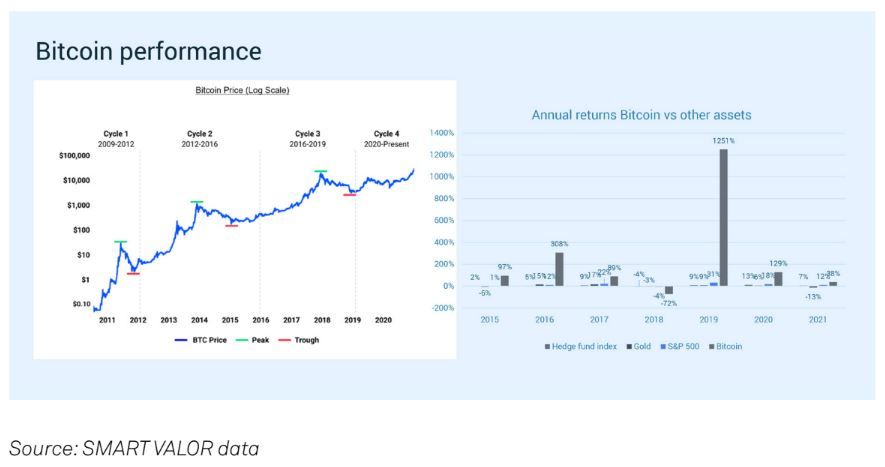

Cryptocurrencies and digital assets are providing excellent alternative investment opportunities with both short-term and long-term targets. On average, Bitcoin has brought investors a 155% return every year for the past five years. Moreover, given the inflation worries and the steady devaluation of national currencies caused by the massive money printing by the U.S. Federal Reserve and the central banks of other countries, cryptocurrencies remain one of the best inflation hedge tools.

In fact, the surveys indicate that high net worth individuals and institutional investors are not alarmed by the recent price correction. On the contrary, they are ready to invest more in cryptocurrencies. At the beginning of July 2021, a survey conducted by Nickel Digital Asset Management found that over 80% of institutional investors expect to increase their exposure to cryptocurrencies and digital assets by 2023. A more recent study found that institutional investors now hold over $77 billion in Bitcoin. The study involved institutions and wealth managers from the U.S., France, Germany, the UK, and the UAE. About 40% of respondents said they would expand their crypto holdings significantly, with less than 1 in 10 claiming they would cut their exposure.

The main reason for buying more crypto is the long-term capital growth potential of digital assets.

Even looking only at the last five years, Bitcoin has delivered an astonishing 3,538.7% return. This means that $10,000 invested into Bitcoin five years ago would now be worth $363,8700.

Thus, this may be a great time to buy crypto at a discount price, thanks to the correction. The question is: What platform should you choose to invest in digital currencies and potentially build your crypto portfolio?

In this article we’ll compare the most important options, focusing mainly on the aspects for European users.

#1 Wallets and Brokers

One popular approach to invest in cryptocurrencies is to use one or several digital wallets. These crypto wallets are special tools that securely store your private keys and enable you to send and receive digital assets. Wallets also enable you to buy and sell crypto in a simple way. They are mostly apps which you can install on your phone such as Bread wallet or Abra. In Germany a popular wallet with which you can buy and sell crypto is Bison, the app offered by Stuttgarter Börse.

A broker also offers the same function: buy, sell and store crypto. The service is mostly provided via desktop version (web browser) rather than mobile app. Broker also offer trading for large crypto positions, via so-called OTC (Over The Counter) trade.

In Switzerland, the most known broker is Bitcoin Suisse. It also offers OTC for large transactions. On the downside, it is only available for users who want to buy or sell in the access of 100,000 CHF. In contrast, SMART VALOR, as currently the only locally regulated full-service investment platform in the region, offers brokerage, custody and exchange (trading), all in one without any limitation of minimal deposit size.

In addition, SMART VALOR has recently partnered with the Swiss Bank Dukascopy to give their clients easy access to digital assets.

#2 Cryptocurrency Exchange Platforms

Crypto exchanges go beyond the functionality of wallets and brokers and offer trading and staking as well. This is the right choice for you if you want to have a broader spectrum of buy and sell options, access to charts and analytical tools and a larger selection of coins. The choice of the right platform also depends on your personal requirements for security and data protection. The amount of capital you want to invest and your needs for customer support also play a role.

US exchanges

One frequently used option are American exchanges such as Kraken, Coinbase or Gemini due to the massive marketing reach these platforms have around the world. These exchanges are excellent choices if you want to do a small, simple transaction and don’t need any support or customer service. The advantage of these exchanges is their great brand, high liquidity and broad selection of coins.

On the disadvantage side there are concerns over privacy, no local customer support, and speed of crypto-to-fiat transactions. As these exchanges, which are aimed at a global audience, are not regulated on a local level, they do not always have local bank accounts. This means wiring funds to your account might take longer and is often more expensive.

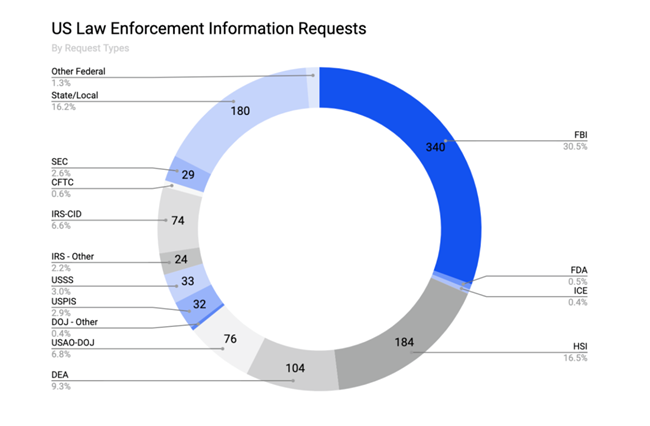

US exchanges require deep KYC and collect a great deal of personal information. They are obliged to share this information with US agencies. Last year, Coinbase revealed that it had received almost 2,000 requests for information about its customers in the first six months alone. About 60% came from U.S. state and federal agencies, such as the FBI, Homeland Security, and the DEA. Other requests came from agencies like the immigration enforcement agency, ICE, and the US Postal Inspection Service. Coinbase also received requests for information from agencies from the UK, Singapore, and other countries. This means that if you are cautious about the privacy of your data, an US exchange might not be your best choice.

Source: coinbase.com

Asian and domicile-less exchanges

The second option are domicile-less exchanges, which do not have a clear home jurisdiction. The Chinese exchanges Binance, Huobi, OkEx are quite popular exchanges. They have a huge selection of coins, high liquidity for big traders and offer also derivative trading. They also tend to have quite low fees. However, this might not be the ideal choice for you, if you deal with relatively large amounts of funds, as such exchanges are normally not regulated and not supervised. In June 2021, the UK, Japan and Singapore ordered Binance’s divisions in their respective countries to cease operations.

In July, Thailand’s Securities and Exchange Commission (SEC) and the Cayman Islands Monetary Authority (CIMA) also announced a regulatory crackdown on Binance. The Thai SEC said that it had filed a criminal complaint against Binance, thus starting a criminal investigation for allegedly operating a crypto business without a license.

In addition, while Binance used to promote itself as a Malta-based company, the Malta Financial Services Authority (MFSA) said that it had never approved Binance to operate in the country. In late February, the MFSA released a public statement, saying that the Chinese exchange was “not authorized by the MFSA to operate in the cryptocurrency sphere.” Reuters conducted extensive research about the issue and found that Binance operated outside the rules that traditional govern traditional finance firms and crypto institutions.

Local exchanges in Europe

In many European markets there are local exchanges, which have been proved and authorized by local regulators. There are several good options such as Crypto.com, a Malta registered exchange operating out of Asia and Bulgaria or Bitstamp, one of the oldest exchanges from Slovenia, registered in Luxembourg. In the German-speaking area, there are several good options such as BitPanda and Bitcoin Group.

In Switzerland there is SMART VALOR which offers around 176 trading pairs and everything from simple buy & sell (brokerage) to advanced trading and asset management for customers who want to delegate investment decisions.

Founded in the Swiss Crypto Valley in 2017, SMART VALOR is one of the first companies to embrace Decentralized Finance (DeFi). It is the only Swiss company operating a full-service digital asset platform authorized by FMA (Financial Market Authority of Liechtenstein) as custodian and exchange provider under the new Blockchain Act (TVTG) and as Financial Intermediary by VQF, a Swiss financial services standards organisation supervised by FINMA (Swiss Financial Market Regulator).

#3 Traditional Financial Players

Several banks and trading platforms started to offer crypto services recently. One of the most known Etoro, the social trading platform caters to active traders who can follow and replicate strategies of other traders. Saxobank has recently added crypto assets to their FX platform.

In Switzerland BBVA launched its first cryptocurrency trading and custody service aimed at its private banking clients. At the moment, this offer enables users to trade and store only Bitcoin, with more cryptocurrencies to be added in the future. In addition, BBVA Switzerland said that it would let users control their investments but not provide advice on this type of investments.

Another Swiss bank and equity trading platform Swissquote also added a limited selection of digital assets to its offering. However it does not offer custody and does not give users physical delivery of digital currencies. This means that you can only buy and hold it on the Swissquote platform but cannot withdraw and move your coins. This has a negative taxation consequence as in this form the proceeds need to be taxed as capital gain due to missing physical delivery.

While banks are viewed as generally secure users typically don't control their private keys, and the services are primarily focused on Bitcoin. As a result, it is more difficult to build a well-diversified crypto portfolio with banks, and the initial deposit requirements might be quite high for regular investors.

Conclusion

Choosing the right investing platform can help you build your crypto portfolio. Before deciding on a platform, it’s important to consider all of your options. While some people use brokers and wallets to manage their crypto portfolios, more people are gravitating toward crypto investing platforms, as they offer more functionalities and features that allow investors to access a broader range of buying and selling options.

If you’re looking for a trusted and secure crypto investment platform, sign up for SMART VALOR today.