There’s more to digital assets than Bitcoin. Over the last decade, the industry has exploded in size and matured beyond belief. The oldest blockchains, Bitcoin and Ethereum, still rule the roost but new contenders have popped up with new ways of doing things that could reinvent the sector. One blockchain has had a rough ride with the press, but the sheer level of innovation, creativity and usage tells me that it could change the industry forever. Its name? Solana.

What is Solana?

Launched in 2017 by Anatoly Yakovenko and now developed by the Solana Foundation, Solana is billed as “the world’s fastest blockchain.” Solana has the potential to solve a number of the digital asset industry’s biggest challenges: slow transactions, high fees and low scalability.

SOL, the native token of the Solana blockchain, has also found itself in the limelight in recent years after it peaked at just over $259 in early November 2021. Fundamentally, SOL powers the blockchain and is used in all gas fees, transactions and smart contracts on Solana. Investors who bought SOL at the beginning of 2021, when it was valued at $1.5 USD, made an annual return of 11,367% after the token ended the year with a $172 price tag. This is quite an impressive price performance, even when compared to leading digital assets such as Bitcoin, which in the same time frame brought investors 59% annual yield and Ethereum’s 417% 2021 annual return. Currently SOL is at $29, which is almost 90% down from its all-time-high of last November but is still one of the top 6 biggest digital assets with market cap of $10 billion at the time of the writing.

Solana to USD chart

Source: Coinmarketcap.com as of 20 October 2022

Because Solana is a Proof-of-Stake (PoS) blockchain, SOL can be staked to help support the network and give users a chance to earn rewards for doing so. PoS blockchains also use far less energy than Proof-of-Work blockchains and consequently have some pretty solid environmental credentials compared to cryptocurrencies such as Bitcoin or even the traditional financial system.

Solana is fast becoming one of the most popular blockchains in cryptocurrency and has earned itself a reputation as a hotbed for creative projects such as NFTs and decentralised finance, with over $11 billion in total value locked according to Solana’s own data and over 800 decentralized applications. It quickly became known as a rising star in the industry and consequently raised over a billion across ICOs and millions in later funding rounds from VCs.

Solana has some lofty ambitions, but can it actually walk the talk? Let’s look at some of the key characteristics of Solana to see how it has the potential to turn the digital asset industry upside down.

Lightning-fast transactions

In the early days of cryptocurrency, transaction speeds were slow and sending and receiving funds from one person to another could take some time. Now, both tech and opinion have moved on. Many people know that some digital assets are not supposed to be used as methods of payment, while those that are can process transactions in the blink of an eye. This is where Solana is leading the charge.

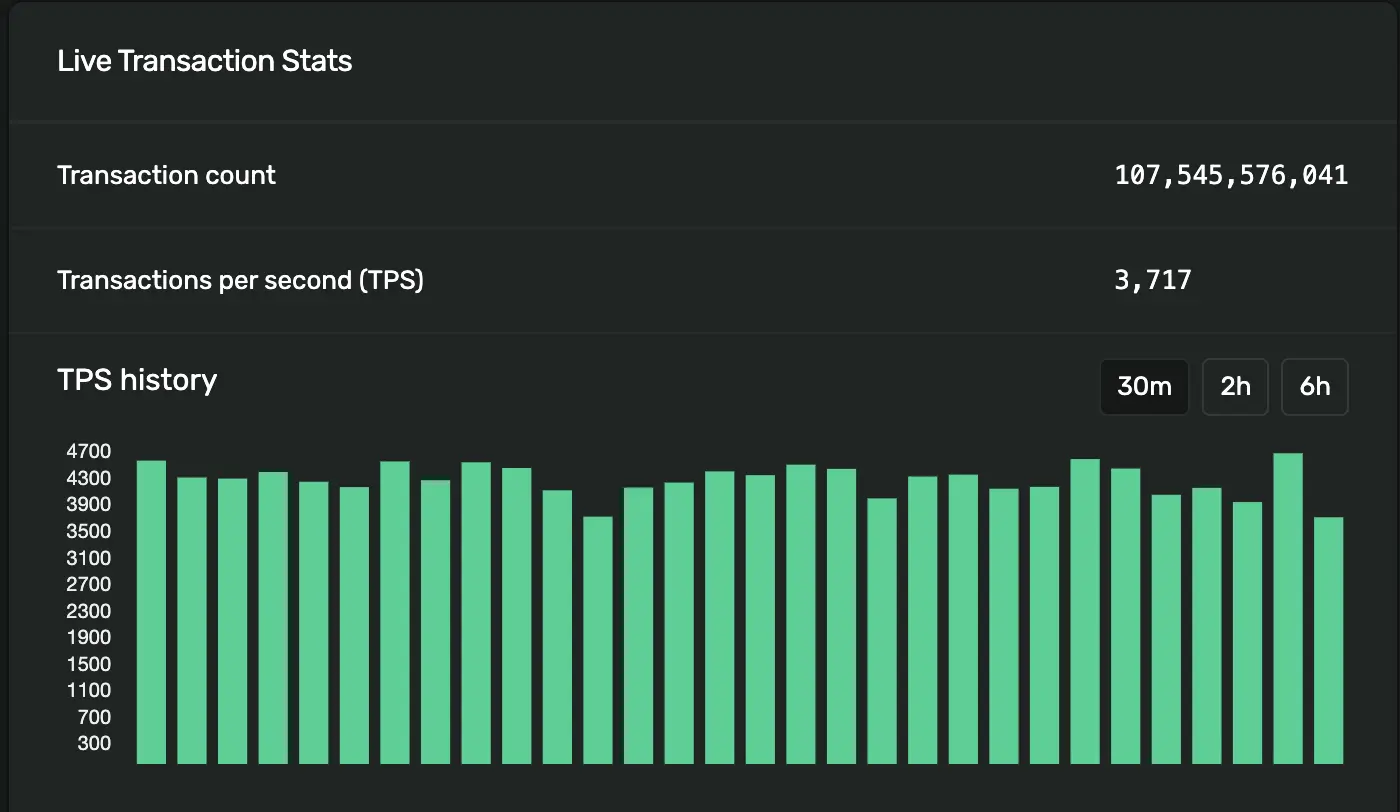

Statistics from Solana showing total transaction count and transactions per second.

Source: Solana Explorer

As it stands, Solana is able to process over 3,000 transactions per second. This is possible due to thousands of validators distributed across the network, bolstered by smaller clusters of around 150 validators that also process transactions. In theory, this, along with a system for timestamping and synchronising payments allows for the network to theoretically process up to 65,000 transactions per second.

While this has only ever been achieved in test net conditions, Solana has the potential to be 10,000 times faster than Bitcoin, 4,000 times faster than Ethereum and 2.5 times faster than Visa. And that’s not the limit of its possibilities. Solana was designed to evolve with the capacity of computing, meaning that it will aim to double its capacity every two years.

Eating Ethereum’s NFT market

The Solana blockchain has already taken a sizeable chunk of Ethereum’s monopoly on the NFT market. In September alone, unique buyers on increased 34% month over month on Solana:

Solana’s NFT market share grew in late August and late September

Source: Blockworks

There’s a reason why. Solana solves a number of issues for NFTs. Almost all the biggest NFT collections are hosted on Ethereum and coincided with a prolonged hype about their value, resulting in a rush to buy them. This made transactions so expensive that for many people using the network, the gas fees were higher than the funds being sent. This also made minting and paying for NFTs a possibility only for those already wealthy. Solana soon filled this gap in the market and went on to own a quarter of the NFT market through its native NFT marketplace Magic Eden.

NFT minting on Solana grew in Q2 2022

Source: Messari

As a result, a new kind of dynamic has evolved. Ethereum is where the blue-chip NFT collections are minted, hosted and sold, whereas Solana is a more accessible market where creators and collectors alike have the opportunity to access the global market. Despite the bear market, Solana’s NFT market spiked 46.6% to over 7 million newly minted NFTs in Q2 of this year.

The DeFi underdog

It may come as no surprise to you that Solana’s speed and affordability make it a popular platform for decentralized finance projects, with over $11 billion in total value locked and around $430 million in daily transaction volume. Solana’s DeFi presence is growing sustainably, with cumulative revenues recently surpassing $5 billion.

Cumulative DeFi revenue on Solana has continued to grow, despite the market downturn.

Source: The Block

There are 180 DeFi projects active on Solana, such as lending platforms Solend and Jet. DeFi also helps stakers club together through protocols such as Marinade and Lido to create liquid staking pools. Solana isn’t just operating in isolation either. Users can use bridges such as Wormhole and Allbridge to interact with the other blockchains like Ethereum.

The reality is that, while Ethereum will always be associated with innovation, there’s no way it can corner the market all for itself. DeFi Solana is undercutting Ethereum much in the same way as NFTs, by promising the same but faster and for less. It’s not a unique strategy, but the one that seems to be working for Solana.

Thinking bigger about adoption – crypto phone & blockchain gaming

The people behind Solana know that bringing about widespread digital asset adoption won’t come from just giving people lightning-fast transactions and low fees. In order to stay ahead of the curve in Web3, they need to facilitate different ways of being an important player across the market.

That’s why Solana is also thinking outside the box about use cases. Crypto gaming is a growing industry around the world that has famously loyal and dedicated users. Solana is entering gaming industry by giving gamers the chance to use real digital assets to power their in-game economies, as well as to get paid to play their favourite games. 97% of gaming executives believe the gaming industry is the centre of the metaverse and research shows that it could have an impact of up to $125 billion on the gaming sector.

Billions of people around the world do not yet have access to traditional financial infrastructure. Instead, they use private payment services via their mobile phones. With phone use increasing in both the developing and developed world, it seems obvious that there is space for a native digital asset device. That’s why Solana Labs announced in June that they will tackle this huge market opportunity by developing both SMS, their mobile platform, and Saga, Solana’s own smartphone.

This mobile phone will give users the opportunity to use the phone as they would any other, but with the added extra of native digital asset compatibility and a practical hardware wallet function. The Saga will also try to cut the Apple App Store’s stranglehold on applications through encouraging decentralized applications compatible with Web3 and digital assets.

Investor favourite

Solana is notable among many of the Ethereum killers that popped up around the same time due to its reputation as an investor favourite. In fact, Solana has some well-known investors, such as FTX founder and Alameda Research founder Sam Bankman-Fried.

It’s easy to see why. Despite being dogged by technical issues such as network outages due to cold storage transaction issues bots overwhelming an NFT minting tool and a $100 million hack through the Mango DeFi service, Solana use from daily unique fee payers has increased to new highs since the last bull run, reaching 450,000 users in the summer of this year.

Unique fee payers on Solana continues to be higher than during the bull run.

Source: Messari

Sam Bankman-Fried thinks that Solana is the most undervalued cryptocurrency on the market and stated his belief that the blockchain will overcome all of its challenges and achieve its goals. It’s high praise indeed from one of the most prominent investors in the entire industry. But it’s not just Sam that’s a fan. Solana is a clear favourite across the investing spectrum, with total year-to-date inflows of $124.1 million. According to Coinshares research, that puts Solana in third place, behind only Bitcoin and multi-asset investments.

The reality of a maturing and increasingly diverse digital assets industry is that a few leading blockchain protocols progressively lose their monopoly over the services they provide. It’s unlikely that their place as the so-called “blue chips” will disappear, but it’s certain that newcomers like Solana will come and occupy new niches adding new way to solve advanced technical problems of scalability and operability, bringing new opportunities to investors.

Conclusion

The unique market position of Solana is attractive not only to institutional investors looking at the fundamentals across all blockchain activity. It is also valuable to retail investors that are looking for utility and a token that could see some serious upside in the next bull market.

I believe that core usage will continue to grow on Solana across key utilities such as NFTs, DeFi and affordable transactions. Solana also stands out as one of the foremost PoS cryptocurrencies, giving investors the opportunity to contribute to a rapidly growing digital asset ecosystem and earn rewards for doing so.

That’s why I’m excited to announce that SMART VALOR, the only Nasdaq-listed digital asset exchange in Europe, has just added SOL. I can’t wait for more investors to find out about SOL, grow their portfolios and experience one of the most important projects in the next stage of crypto.

Disclaimer

The data provided in this blog is for information purposes only and should not be construed as investment or tax advice nor as a recommendation to buy, sell, or hold any particular security. SMART VALOR believes the data in this blog post is accurate, but does not verify its accuracy independently and does not warrant or guarantee that it is accurate or complete. SMART VALOR has no obligation to provide any updates or changes to the data. No investment decisions should be made using this data.

Risk disclosure

Cryptocurrencies can fluctuate widely in prices and incur permanent loss of capital and are therefore not appropriate for all investors. Trading cryptocurrencies is not supervised by any EU regulatory framework. Past performance does not guarantee future results. Trading history presented is less than 5 years and may not suffice as basis for an investment decision. More information is available under Risk Disclosure.